Investing can often feel like navigating a complex maze, especially when it comes to balancing risk and returns. Arbitrage fund can be an appealing choice for those looking for low-risk investment options. These funds aim to take advantage of price differences in various markets, allowing investors to earn returns with relatively low risk. In this blog, we will delve into the concept of arbitrage funds and highlight Tata Arbitrage Fund, one of the available options for those looking to invest in this category.

What Are Arbitrage Funds?

Arbitrage funds are mutual funds that aim to profit from price discrepancies between the cash and derivatives markets. By simultaneously buying and selling securities, these funds can lock in profits while minimizing risk. This strategy is particularly effective in volatile markets, where price differences are more common.

How Do Arbitrage Funds Work?

- Investment Strategy: Fund managers identify opportunities where the price of a security in the cash market differs from its price in the futures market. They buy the security in the cheaper market and sell it in the more expensive market, securing a profit.

- Asset Allocation: Typically, arbitrage funds invest primarily in equities and equity derivatives, while also maintaining a portion of their portfolio in debt and money market instruments for liquidity.

- Risk Management: By focusing on arbitrage opportunities, these funds aim to provide stable returns with lower risk compared to traditional equity funds.

Why Consider the Tata Arbitrage Fund?

The Tata Arbitrage Fund is designed to offer investors a balanced approach to low-risk investing. Here are some reasons to consider this fund:

1. Professional Management

The fund is managed by experienced professionals who actively seek out arbitrage opportunities, ensuring that the fund capitalizes on the best available strategies.

2. Diversification

With investments spread across equities, derivatives, and debt instruments, the Tata Arbitrage Fund provides a well-rounded portfolio that can help mitigating risks associated with market fluctuations.

3. Liquidity

As an open-ended scheme, the Tata Arbitrage Fund allows investors to buy and sell units at the prevailing Net Asset Value (NAV) on any business day, ensuring easy access to funds.

4. Tax Efficiency

The fund benefits from equity taxation advantages, making it a tax-efficient choice for investors looking to optimize their returns.

Who Should Invest in Arbitrage Funds?

Arbitrage funds, including the Tata Arbitrage Fund, are suitable for:

- Conservative Investors: Those seeking low-risk investment options with stable returns.

- Short-Term Investors: Ideal for individuals with a short- to medium-term investment horizon.

- Tax-Conscious Investors: Those looking for tax-efficient investment strategies.

How to Invest in Tata Arbitrage Fund

Investing in the Tata Arbitrage Fund is simple. Here is how you can get started:

- Go to the Tata Mutual Fund website, then navigate to the mutual fund login page

- You can also visit the Tata Arbitrage Fund page and click ‘Start Investing’

- Alternatively, you can invest through any investment portal, distributor, or offline at Tata Mutual Fund’s branch offices.

Conclusion

Arbitrage funds offer a unique opportunity for investors looking for relatively low-risk, tax-efficient investment options while aiming to provide relatively stable returns. The Tata Arbitrage Fund exemplifies this strategy, providing professional management, diversification, and liquidity. Whether you're a conservative investor or someone looking to diversify your portfolio, this fund can be a valuable addition to your investment strategy.

Invest wisely and consider Tata Arbitrage Fund for your investment journey today!

Tata Arbitrage Fund (Scheme Details)

- Scheme Name: Tata Arbitrage Fund

- Scheme Category: Arbitrage Fund

- Scheme Type: An open-ended scheme investing in arbitrage opportunities.

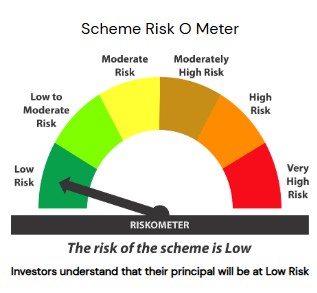

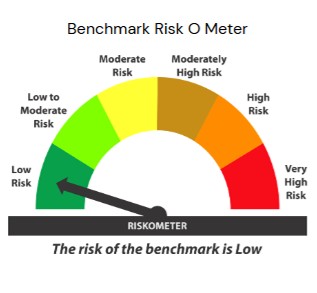

RiskometerThis product is suitable for investors who are seeking*

| |

|

|

It may be noted that risk-o-meter specified above is based on internal assessment. The same shall be updated as per provision no. 17.4.1.i of SEBI Master Circular on Mutual Fund dated 27.06.2024, on Product labelling in mutual fund schemes on ongoing basis.

Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.