Jab Life Maange More, Badho Mutual Funds Ki Ore.

Ab SIP se, Sara Desh Kare Nivesh.

In a world of endless possibilities, our dreams often outpace our means. But with the power of SIP, a method of investing in mutual funds, you could bridge the gap between your aspirations and reality. Let regular investments be the wind beneath your wings, propelling you towards your financial goals.

Whether you envision a lavish wedding, a world-class education, or the freedom to pursue your entrepreneurial dreams, investing in mutual funds through SIPs could help you achieve them.

Join the millions of Indians who aim to transform their financial landscapes with SIPs in mutual funds. Together, let us embody the spirit of "Ab SIP se, Sara Desh Kare Nivesh," empowering ourselves and our nation to achieve dreams that once seemed out of reach.

Exclusive Series

BAF Learning

BAF LearningSIP Calculator

Determine your monthly SIP amount to reach your goal.

Mutual Fund Investment 101

Get an overview of the basics and get started on your first mutual fund investment.

Gilt Fund - Meaning, Features and Benefits

When it comes to balancing risk and stability in your investment portfolio, debt mutual funds often emerge as a preferred option. Among the various debt categories available in India, one that stands out for its (low credit risk) sovereign backing is the gilt fund. But what exactly is a gilt fund, and how can it fit into your financial planning?

This article breaks down the meaning of gilt funds, explains what gilt funds invest in, outlines their features and benefits, and helps you understand if they’re suitable for your investment goals.

What is a Gilt Fund?

Let’s begin with the basic meaning of gilt fund.

A gilt fund is a type of debt mutual fund that invests primarily in government securities. These are bonds or treasury bills issued by the central or state government to fund various operations and developmental projects.

Since the securities are backed by the government, they carry minimal default risk. This makes gilt mutual funds one of the better avenues for conservative investors looking for relatively stable potential returns over the medium to long term.

To clarify further:

● Gilt funds invest in predominantly in sovereign securities

● These funds are actively managed to take advantage of interest rate movements

Key Features of Gilt Funds

Now that you understand the basic definition, let’s explore the characteristics that define gilt mutual funds.

Government-Backed Securities

The standout feature of gilt funds is its exclusive investment in central and state government securities. This reduces credit risk to low level.

Interest Rate Sensitivity

Gilt funds are highly sensitive to changes in interest rates. When interest rates fall, bond prices rise - allowing gilt funds to generate capital gains. Conversely, in rising rate environments, fund values decline.

Medium to Long-Term Horizon

Given their volatility due to interest rate movements, gilt funds are better suited for investors with a 3 to 5-year horizon or longer.

Actively Managed

These funds are managed by professional fund managers who adjust the portfolio duration to navigate interest rate cycles effectively.

Gilt Funds vs Other Debt Mutual Funds

It’s essential to understand how gilt funds compare to other types of debt mutual funds.

| Gilt Fund | Corporate Bond Fund | Liquid Fund | |

|---|---|---|---|

| Predominant Investment | Government Securities | AA+ & above rated Corporate Bonds | Debt and money market securities with residual maturity of upto 91 days only. |

| Suitable Holding Period | 3–5 years | 2–3 years | <1 year |

| Interest Rate Sensitivity | High | Moderate/High depending upon duration | Low |

Unlike other mutual funds, gilt funds are not exposed to low credit risk since invest in instruments with low default probabilities. However, their interest rate risk is relatively higher.

Benefits of Investing in Gilt Funds

If you are interested in investing in gilt funds, these are the benefits that come your way.

Sovereign Safety

The biggest draw of gilt mutual funds is that the underlying investments are backed by the Government of India. This virtually eliminates the risk of default.

Portfolio Diversification

Adding a gilt fund to your existing mix of equity and debt mutual funds can offer portfolio balance, especially during volatile equity phases.

Capital Appreciation in Falling Rate Cycles

When interest rates drop, bond prices rise. Gilt fund returns tend to be higher during such cycles due to mark-to-market gains on existing bonds.

Transparency

These funds are transparent, with details of holdings, average maturity, and duration available in the Scheme Information Document (SID), Fortnightly Portfolio, Monthly Portfolio and monthly fact sheets.

Who Should Consider Gilt Funds?

Gilt funds are suitable for the following investor profiles:

- Conservative Investors: Those who want exposure to debt markets but want low credit risk.

- Long-Term Debt Investors: Investors with a long-term view can benefit from interest rate cycles.

- Goal-Based Investors: Suitable for medium-term goals like buying a car, planning for a child’s education, or building a contingency fund.

- Experienced Debt Investors: Those looking to tactically allocate during rate cuts.

Gilt Fund Returns: What to Expect

While gilt fund returns are not fixed or guaranteed, it’s crucial to remember:

- Gilt funds do not pay fixed interest like a bond. Instead, NAVs rise or fall based on bond price movements.

- Returns are influenced by the average maturity of bonds in the portfolio and the prevailing interest rate scenario.

- Short-term volatility may occur, especially if rates rise unexpectedly.

How Do Gilt Funds Work?

The working of a gilt fund can be explained in a simple step-by-step manner:

- The Government Issues Bonds – These bonds have fixed coupons and maturity dates.

- The Fund Buys Bonds – The fund manager purchases these bonds for the portfolio.

- NAV Reflects Market Value – The NAV fluctuates based on how bond prices change in the open market.

- You Invest or Redeem – Investors can buy or redeem units at the prevailing NAV, subject to exit load (if any).

The key driver of returns is bond price movement, which is tied to interest rate expectations and monetary policy actions.

Risks Associated with Gilt Funds

Even though gilt mutual funds are considered having low credit risk, here are a few things to watch out for:

- Interest Rate Risk: NAVs can fluctuate sharply when interest rates move.

- No Guarantee of Returns: These are market-linked products. While gilt fund returns are not fixed.

- Liquidity Risk: In times of low demand, fund houses may face challenges in selling bonds at optimal prices.

However, these risks are generally lower compared to corporate bond funds or credit risk funds

How to Choose the Right Gilt Fund?

Before investing, consider the following:

- Fund’s average maturity and modified duration

- Fund manager’s track record

- Expense ratio

- Exit load terms

- Transparency and disclosures in SID & KIM

You can also use a reliable mutual fund app or aggregator platform to compare different gilt mutual funds based on risk, return, and investment style.

SIP or Lump sum – Which is Better?

Both investment modes are allowed:

- SIP (Systematic Investment Plan): for long-term investors wanting to average out volatility.

- Lump sum: Better used when interest rates are high and poised to fall - allowing you to capture capital appreciation.

You can monitor your investments through a dashboard or receive a consolidated mutual fund statement monthly to track progress.

Final Thoughts

To sum it up, gilt funds’ meaning stretches beyond just “government bonds.” They represent a relatively stable and transparent way to access the bond market with minimal credit risk.

For investors looking for debt mutual funds’ return, relative stability, diversification, and a hedge against equity volatility, gilt funds are a worthy consideration. Their sovereign backing and professional management make them suitable for both seasoned investors and cautious beginners.

Disclaimers:

An Investor Education and Awareness Initiative by Tata Mutual Fund

To know more about KYC documentation requirements and procedure for change of address, phone number, bank details etc., please visit: https://www.tatamutualfund.com/deshkarenivesh

Please deal only with registered Mutual Funds, details of which can be verified on the SEBI website under ‘Intermediaries / Market infrastructure institutions.’

All complaints regarding Tata Mutual Fund may be directed to service@tataamc.com and/or https://scores.sebi.gov.in/ (SEBI SCORES portal) and/or https://smartodr.in/login

- Nomination is advisable for all folios opened by an individual especially with sole holding as it facilitates an easy transmission process.

- This communication is a part of investor education and awareness initiative of Tata Mutual Fund.

Smart Beta Funds – What are Smart Beta Mutual Funds and How is it Different from Other Index Funds?

In the evolving world of mutual fund investing, passive strategies like index investing have gained massive traction. While traditional index funds simply replicate a market index, a more nuanced approach known as smart beta funds is steadily gaining popularity among investors.

Smart beta funds are designed to bridge the gap between actively managed funds and passively tracked ones by using pre-defined, rules-based strategies to select and weight stocks within an index. They aim to deliver better risk-adjusted returns by avoiding the shortcomings of purely market-cap-weighted portfolios.

But what exactly are smart beta mutual fund options, and how do they differ from conventional index mutual funds? This article explores everything you need to know about smart beta funds, how they work, and why they might be a worthwhile addition to your portfolio.

What is the Meaning of Smart Beta Funds?

To begin, let’s understand the smart beta funds meaning. A smart beta mutual fund combines elements of both active and passive investing. While it seeks to mirror a benchmark index like a passive fund, it also applies strategic filters and alternative weighting schemes like actively managed funds.

Instead of following traditional market capitalisation-based allocations, smart beta strategies use factors like value, momentum, low volatility, dividend yield, and quality. The goal is to capture specific investment styles or anomalies that have historically outperformed the broader market over long periods.

How Do Smart Beta Index Funds Work?

Unlike traditional index mutual funds, which passively track indices such as the Nifty 50 or BSE Sensex Index Fund using market cap weightings, smart beta index funds follow a set of predefined rules that determine how stocks are selected and weighted.

These rules are based on fundamental or technical metrics that aim to improve the portfolio’s performance or reduce its risk. For example, a smart beta fund focused on low volatility may only include stocks with historically lower price fluctuations. This approach attempts to limit downside risk while still participating in market upside. Similarly, a value-focused smart beta strategy might give greater weight to undervalued companies with strong balance sheets and steady earnings.

Smart Beta vs Traditional Index Funds

Here’s a more detailed look at how smart beta funds differ from traditional index funds:

- Traditional Index Funds: These replicate standard market indices like the Nifty 50 or BSE Sensex Index Fund, assigning weight to constituents purely based on market capitalisation. They offer broad market exposure and are low-cost, but they can become overly concentrated in the most valuable companies, potentially ignoring fundamentals.

- Smart Beta Funds: These track customised indices based on rule-driven strategies. They adjust constituent weightings using factors like earnings quality, momentum, or volatility. The objective is to correct perceived inefficiencies in traditional indices and aim to provide enhanced returns or lower risk.

Why Consider Smart Beta Funds?

Investors are turning to smart beta strategies for several key reasons. Firstly, smart beta offers a middle ground between low-cost passive investing and the flexibility of active management. They give exposure to investment factors that have historically contributed to outperformance, without relying solely on fund managers’ discretion.

Secondly, smart beta strategies allow for better diversification. A smart beta mutual fund might spread investments across value, growth, quality, and low volatility factors – aiming to provide potentially high returns through different market cycles.

Finally, smart beta funds are transparent and rules-based. This predictability allows investors to understand exactly how the fund is constructed and make informed decisions based on that methodology.

Types of Smart Beta Strategies

Smart beta investing isn’t a one-size-fits-all approach. There are multiple strategies that investors can choose from depending on their risk appetite, investment horizon, and market outlook:

- Value-Based: Targets undervalued companies by evaluating ratios like price-to-earnings and price-to-book. It aims to benefit when market valuations revert to fair value.

- Momentum-Based: Focuses on stocks that have shown upward price trends in recent months. This strategy assumes that winning stocks will continue to perform well in the near term.

- Low Volatility: Seeks to reduce overall portfolio volatility by investing in stable, less volatile companies. Particularly useful in turbulent market conditions.

- Quality-Based: Invests in financially healthy companies with strong balance sheets, high return on equity, and low debt levels.

- Size-Based: Focuses on mid-cap exposure, offering a blend of stability and growth. Indices like the Sensex Midcap provide the base universe for these strategies.

Things to Consider Before Investing

Before adding a smart beta mutual fund to your portfolio, consider the following:

- Factor Relevance: Not all factors perform well in all market conditions. Understand which factor aligns best with your financial goals.

- Tracking Error: Smart beta funds may deviate from benchmark performance due to non-market cap weighting.

- Fees: Although generally cheaper than active funds, some smart beta strategies may have slightly higher expense ratios than traditional passive funds.

- Time Horizon: Many factors like value and quality require long holding periods to deliver superior returns.

- Portfolio Fit: Ensure that the chosen smart beta fund complements your existing investment strategy rather than duplicating exposures.

Smart Beta Funds in the Indian Context

India’s mutual fund landscape is evolving rapidly, and smart beta funds have emerged as an innovative option for investors seeking nuanced, rule-based equity exposure. Though still a relatively new concept in India, these mutual funds are being increasingly launched by major asset management companies to cater to investor demand for structured equity strategies.

The appeal lies in their potential to outperform standard index mutual funds in certain market phases while maintaining transparency and consistency. For example, a smart beta fund based on a low-volatility index may outperform in downturns, while a momentum-based fund could shine during bull markets.

Several fund houses now offer multi-factor smart beta ETFs and index funds tracking custom indices developed by NSE or BSE that focus on factors such as alpha, value, and quality.

Smart Beta or Traditional Index Funds: What Should You Choose?

Deciding between smart beta funds and traditional index funds depends on your investment goals, time horizon, and risk tolerance:

- Choose traditional index funds if your primary goal is broad market exposure at the lowest cost and minimal tracking error.

- Opt for smart beta mutual fund strategies if you want factor-specific returns, such as value or quality, and are comfortable with slight complexity and risk.

For instance, if your objective is to avoid over-concentration in large caps while still maintaining passive exposure, smart beta may offer a more diversified solution. On the other hand, if you’re just beginning your investment journey, starting with a standard BSE Sensex Index Fund might make more sense.

Conclusion

Smart beta funds bring a rules-based, disciplined approach to equity investing. They bridge the gap between traditional passive funds and active management by applying factor-based screening and weighting methods.

Investors looking to optimise returns while still enjoying the transparency and low cost of passive investing may find smart beta mutual fund options a strong addition to their portfolios. As always, it’s important to understand the specific strategy used by the fund, review its fact sheet, and ensure it aligns with your long-term financial goals.

Disclaimers:

An Investor Education and Awareness Initiative by Tata Mutual Fund

To know more about KYC documentation requirements and procedure for change of address, phone number, bank details etc., please visit: https://www.tatamutualfund.com/deshkarenivesh

Please deal only with registered Mutual Funds, details of which can be verified on the SEBI website under ‘Intermediaries / Market infrastructure institutions.’

All complaints regarding Tata Mutual Fund may be directed to service@tataamc.com and/or https://scores.sebi.gov.in/ (SEBI SCORES portal) and/or https://smartodr.in/login

Nomination is advisable for all folios opened by an individual especially with sole holding as it facilitates as easy transmission process.

Tata Multi Allocation Fund – Make Your Investing Simple with Multi Allocation Fund

In today’s fast-paced world, managing multiple investments can often feel overwhelming - especially when they’re scattered across asset classes and platforms. What if there was a way to streamline this process and invest smartly across equity, debt, and gold - all under one roof?

Enter the Tata Multi Allocation Fund, a thoughtfully designed mutual fund that brings convenience, balance, and diversification together. For those seeking simplicity, asset allocation, and long-term wealth creation, this fund can help you consolidate your investment journey.

Before diving into the specifics, it’s worth highlighting the importance of organized financial tracking tools - like a consolidated mutual fund statement or a reliable mutual fund app - that support and enhance your investment experience.

What is a Multi Asset Fund?

A multi asset fund, as the name suggests, is an open-ended mutual fund that invests across at least three asset classes. These typically include:

- Equity (for growth)

- Debt (for stability and income)

- Commodities like gold or silver (for inflation protection)

This balanced allocation is designed to reduce risk while enhancing the consistency of returns across market cycles. A fund like the Tata Multi Allocation Fund takes this a step further by actively managing allocations based on market dynamics.

The Problem with Fragmented Investing

Many investors use multiple funds and platforms to diversify - resulting in scattered portfolios and complex tracking. You might download separate apps, juggle paperwork, or sift through emails just to get a full picture of your holdings.

This is where having a consolidated mutual fund statement or accessing all mutual funds in one place via a mutual funds mobile app becomes a game changer.

By investing in an all-in-one mutual fund like Tata Multi Allocation Fund, investors can reduce clutter and bring focus back to long-term goals, rather than just micromanaging accounts.

Diversification by Design

Rather than manually investing in separate equity, debt, or gold schemes, this fund offers a single-window solution. It allocates dynamically across:

- Domestic equities

- Fixed income instruments.

- Gold Exchange Traded Funds (ETFs)

This structure ensures that different asset classes cushion each other during volatile markets.

Risk Management

By not putting all your money in one type of asset, you reduce the impact of any single asset underperforming. The fund’s allocation flexibility is its biggest strength - especially during market corrections.

Tactical Allocation

The fund isn’t just passive. Fund managers make tactical calls based on market movements. For example, if equities are expected to rally, allocation towards equity may be increased and reduced when volatility spikes.

Benefits of Multi Asset Funds

Here are a few compelling reasons why multi asset funds are gaining popularity among Indian investors:

- Convenience: Avoid the hassle of multiple fund selections

- Single Folio Simplicity: One mf statement captures everything

- Automatic Rebalancing: No need to manually switch between asset classes

- Tax Efficiency: No capital gains tax until you redeem

- Tracking Ease: Access via a single mutual fund app or platform

In fact, many fund houses now offer smart features where you can download mutual fund statements across all your holdings - making tracking easier than ever.

How Does the Fund Perform in Different Market Conditions?

Multi asset funds are uniquely positioned to weather a range of market conditions:

- In a bull equity market, the equity component drives returns

- In falling interest rate scenarios, debt may contribute positively

- During inflation or uncertainty, gold typically performs well

While no investment is risk-free, this strategic blend of assets aims to cushion your portfolio against extremes and deliver stable returns over time.

Who Should Consider Investing?

This fund is suitable for:

- First-time investors unsure about asset allocation

- Salaried professionals who prefer SIPs in balanced funds

- Investors looking to consolidate equity, debt, and gold in one portfolio

- Those seeking diversification without managing multiple funds

If you’re someone who prefers simplicity, consolidated reporting, and reliable diversification, this is your fund.

SIP vs. Lumpsum - What’s Better?

Managing your investments doesn’t have to be complicated. Here's how you can simplify the process:

- Use platforms that offer all in one mutual fund access

- Ensure you get a consolidated mutual fund statement monthly or quarterly

- Check NAV trends and asset allocation regularly on your mutual fund’s mobile app

- Review your MF statement for changes in holdings, performance, and any redemptions

This routine ensures you stay informed without being overwhelmed.

Tax Implications

Multi asset funds are taxed based on their equity or debt exposure. If the equity allocation remains above 65%, the fund is treated like an equity fund for taxation.

- Short-Term Capital Gains (STCG): Taxed at 15% if redeemed within one year

- Long-Term Capital Gains (LTCG): Gains above Rs. 1 lakh taxed at 10% without indexation after one year

Tax efficiency, along with asset diversity, makes these funds attractive for long-term financial planning.

Points to Keep in Mind Before Investing

- SEBI-Compliant Fund: The fund adheres to all SEBI regulations. No assured returns or misleading promises.

- Long-Term Approach Recommended: To benefit from asset rebalancing and compounding

- Exit Loads: Review the SID for details on applicable exit charges

- Volatility: Returns can fluctuate, especially in short-term equity cycles

Always read the Scheme Information Document (SID) and Key Information Memorandum (KIM) before investing.

Why the Tata Multi Asset Fund Stands Out

Among multi asset schemes in the market, Tata Multi Allocation Fund is backed by:

- A trusted brand with decades of fund management experience

- Expert asset allocation models tailored to Indian investors

- Transparent reporting and digital access to performance metrics

- Availability in regular and direct plans for different investor preferences

Its simplicity and structured diversification make it a compelling choice for first-time and seasoned investors alike.

Final Thoughts

In a complex and often volatile investment landscape, the Tata Multi Allocation Fund offers a refreshing approach - simple, diversified, and rooted in risk-adjusted growth. For investors looking for an all-in-one mutual fund solution that spans equities, debt, and gold, this fund is a strong contender.

Combined with digital platforms that let you track your MF statement, view all mutual funds in one place, and download mutual fund statements easily, this solution brings clarity and peace of mind.

Whether you’re starting your investment journey or aiming to consolidate your portfolio, the Tata Multi Asset Fund can help you make smarter, well-rounded financial choices.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Tata Ethical Fund: A Shariah Compliant Investment Aligned with Your Values

In a country as diverse as India, the demand for investment solutions that align with personal values and ethical beliefs is steadily growing. For many investors who seek to align their finances with faith-based principles, Shariah compliant mutual funds offer a transparent and responsible way to participate in capital markets. Among the most established offerings in this category is the Tata Ethical Fund.

This article aims to explore the philosophy behind Shariah investment, explain how the Tata Ethical Mutual Fund is structured, and help investors understand how such funds can support their long-term financial goals without compromising their ethical framework.

What is a Shariah Compliant Mutual Fund?

A Shariah compliant mutual fund is a type of investment fund that adheres to Islamic principles as outlined in the Shariah, or Islamic law. These funds avoid investing in businesses that deal with interest-based financial services, alcohol, tobacco, gambling, and other activities considered non-compliant under Shariah.

Key Features of Shariah Mutual Funds:

- Avoid interest (riba) and debt-laden companies

- Exclude sectors like liquor, entertainment, banking, and insurance

- Select companies based on ethical business practices

- Guided by a Shariah Board of scholars who review and certify the fund’s portfolio

In India, such funds are available to all investors - regardless of religion - who wish to follow an ethical or socially responsible approach to investing.

Introduction to Tata Ethical Fund

The Tata Ethical Fund is a pioneering equity mutual fund in India built on the principles of Shariah investment. Launched in 1996, it remains one of the oldest and most respected offerings in this category.

Highlights:

- Invests in companies that are certified as Shariah compliant

- Actively managed, with a focus on long-term capital appreciation

- Follows a disciplined stock-picking approach guided by an internal research team and Shariah Board

The fund aims to deliver returns by focusing on businesses that demonstrate strong fundamentals, financial prudence, and compliance with ethical investment norms.

What Makes Shariah Investing Unique?

Unlike traditional equity funds, a Shariah fund evaluates stocks not just on financial metrics but also on ethical compliance. This includes:

- Low debt-to-equity ratio

- Clean sources of income

- Absence from sectors prohibited under Shariah law

As a result, these funds typically show a bias towards sectors like:

- Pharmaceuticals

- Information Technology

- Engineering

- Fast-Moving Consumer Goods (FMCG)

This approach not only helps to align with moral values but also ensures that the investment is grounded in sound financial principles.

Who Can Invest in Tata Ethical Mutual Fund?

While the fund is Shariah-compliant by design, it is open to all investors - regardless of faith - who are looking for:

- An ethical investment vehicle

- Diversified equity exposure

- Long-term capital appreciation

- Portfolio alignment with socially responsible investing principles

Investors are comfortable with avoiding sectors like banking, alcohol, and entertainment, and focusing on fundamentally strong businesses may find this fund suitable.

Why Consider Shariah Compliant Mutual Funds?

Here are a few reasons why investors are increasingly considering mutual fund Shariah compliant options:

Ethical Alignment

Invest according to your values without compromising on potential growth opportunities.

Financial Discipline

The fund inherently screens for companies with low debt and clean financial records.

Long-Term Growth

With the right asset allocation and discipline, Shariah funds have shown the potential to deliver wealth over the long term.

Transparent Process

These funds are guided by a Shariah Board, ensuring continuous monitoring and compliance.

How Does Tata Ethical Fund Work?

The fund manager of Tata Ethical Fund follows a multi-step investment process:

- Screening: Initial filtration based on Shariah compliance - excluding all prohibited industries

- Financial Metrics: Evaluation of earnings quality, balance sheet strength, and growth potential

- Fundamental Analysis: Focus on companies with robust corporate governance and capital efficiency

- Ongoing Compliance: Periodic reviews by the Shariah advisory board to ensure continued adherence

The fund is actively managed, meaning that stocks are regularly bought or sold based on market conditions and compliance updates.

Key Benefits of Tata Ethical Fund

Here’s what makes the Tata Ethical Mutual Fund stand out:

- SEBI-registered open-ended equity scheme

- Run by experienced fund managers

- Supported by one of India’s most trusted financial groups

- Enables investors to participate in equity markets with ethical clarity

If you prefer to avoid companies that go against your values, this fund allows you to do so without stepping away from financial markets.

Tata Ethical Fund NAV and Plan Options

Investors can track the Tata Ethical Fund NAV (Net Asset Value) on the Tata Mutual Fund website or any registered financial platform. NAV helps assess the current per-unit value of the mutual fund and is updated daily.

Available Plans:

- Tata Ethical Fund Direct Plan Growth

- Regular Plan – suitable for investors going through a distributor

Choosing between the two depends on your investment preference and whether you seek advisory assistance or prefer a direct route with lower expense ratios.

Investing in Tata Ethical Fund: SIP or Lumpsum?

Like most mutual funds, the Tata Ethical Fund allows investments through:

- Systematic Investment Plans (SIP): Suitable for building wealth gradually with monthly contributions

- Lumpsum Investments: Suitable for investors with available capital and long-term goals

Using a SIP calculator or investment return calculator can help estimate future wealth accumulation and create a customized plan for financial goals like education, retirement, or home purchase.

Risk Factors to Keep in Mind

While Shariah mutual funds are designed with discipline, they are not risk-free. Here are some points to consider:

- Sector Concentration: Avoiding certain sectors may lead to concentration in others

- Market Risk: Like all equity funds, returns depend on market movements and are not guaranteed

- Liquidity Risk: May face limited stock choices, especially in narrow markets

Investors are advised to stay invested for a period of 5 years or more to ride out market cycles and potentially maximize returns.

Who Should Consider Investing?

The Tata Ethical Fund may be suitable for:

- Faith-driven investors seeking Shariah investment opportunities

- Long-term investors with a very high risk appetite

- Individuals who want to align personal ethics with portfolio choices

How to Get Started

To begin your journey with Tata Ethical Mutual Fund, follow these steps:

- Complete KYC formalities

- Choose between Direct or Regular Plan

- Decide SIP or lumpsum

- Select goal and investment horizon

- Track progress using NAV and periodic statements

Investors can also seek guidance from registered mutual fund distributors or visit www.tatamutualfund.com for more information.

Final Thoughts

Ethical investing is no longer a niche concept. With funds like the Tata Ethical Fund, investors can now make decisions that are both financially sound and morally aligned. Whether you are driven by religious values, ethical convictions, or the desire for responsible investing, Shariah compliant mutual funds offer a structured way to grow your wealth.

In a market filled with choices, the Tata Ethical Fund brings clarity, transparency, and a focused approach to potential long-term capital appreciation - without compromising on your values.

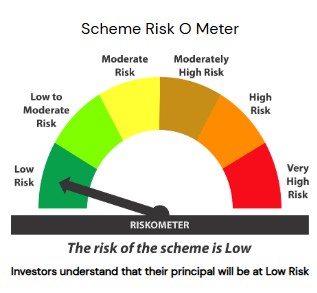

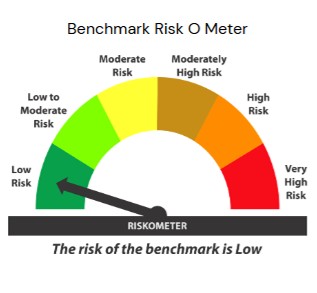

| This product is suitable for investors who are seeking*

|

|

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Arbitrage Funds in Mutual Funds: Meaning, Features and Suitability

Investing can often feel like navigating a complex maze, especially when it comes to balancing risk and returns. Arbitrage fund can be an appealing choice for those looking for low-risk investment options. These funds aim to take advantage of price differences in various markets, allowing investors to earn returns with relatively low risk. In this blog, we will delve into the concept of arbitrage funds and highlight Tata Arbitrage Fund, one of the available options for those looking to invest in this category.

What Are Arbitrage Funds?

Arbitrage funds are mutual funds that aim to profit from price discrepancies between the cash and derivatives markets. By simultaneously buying and selling securities, these funds can lock in profits while minimizing risk. This strategy is particularly effective in volatile markets, where price differences are more common.

How Do Arbitrage Funds Work?

- Investment Strategy: Fund managers identify opportunities where the price of a security in the cash market differs from its price in the futures market. They buy the security in the cheaper market and sell it in the more expensive market, securing a profit.

- Asset Allocation: Typically, arbitrage funds invest primarily in equities and equity derivatives, while also maintaining a portion of their portfolio in debt and money market instruments for liquidity.

- Risk Management: By focusing on arbitrage opportunities, these funds aim to provide stable returns with lower risk compared to traditional equity funds.

Why Consider the Tata Arbitrage Fund?

The Tata Arbitrage Fund is designed to offer investors a balanced approach to low-risk investing. Here are some reasons to consider this fund:

1. Professional Management

The fund is managed by experienced professionals who actively seek out arbitrage opportunities, ensuring that the fund capitalizes on the best available strategies.

2. Diversification

With investments spread across equities, derivatives, and debt instruments, the Tata Arbitrage Fund provides a well-rounded portfolio that can help mitigating risks associated with market fluctuations.

3. Liquidity

As an open-ended scheme, the Tata Arbitrage Fund allows investors to buy and sell units at the prevailing Net Asset Value (NAV) on any business day, ensuring easy access to funds.

4. Tax Efficiency

The fund benefits from equity taxation advantages, making it a tax-efficient choice for investors looking to optimize their returns.

Who Should Invest in Arbitrage Funds?

Arbitrage funds, including the Tata Arbitrage Fund, are suitable for:

- Conservative Investors: Those seeking low-risk investment options with stable returns.

- Short-Term Investors: Ideal for individuals with a short- to medium-term investment horizon.

- Tax-Conscious Investors: Those looking for tax-efficient investment strategies.

How to Invest in Tata Arbitrage Fund

Investing in the Tata Arbitrage Fund is simple. Here is how you can get started:

- Go to the Tata Mutual Fund website, then navigate to the mutual fund login page

- You can also visit the Tata Arbitrage Fund page and click ‘Start Investing’

- Alternatively, you can invest through any investment portal, distributor, or offline at Tata Mutual Fund’s branch offices.

Conclusion

Arbitrage funds offer a unique opportunity for investors looking for relatively low-risk, tax-efficient investment options while aiming to provide relatively stable returns. The Tata Arbitrage Fund exemplifies this strategy, providing professional management, diversification, and liquidity. Whether you're a conservative investor or someone looking to diversify your portfolio, this fund can be a valuable addition to your investment strategy.

Invest wisely and consider Tata Arbitrage Fund for your investment journey today!

Tata Arbitrage Fund (Scheme Details)

- Scheme Name: Tata Arbitrage Fund

- Scheme Category: Arbitrage Fund

- Scheme Type: An open-ended scheme investing in arbitrage opportunities.

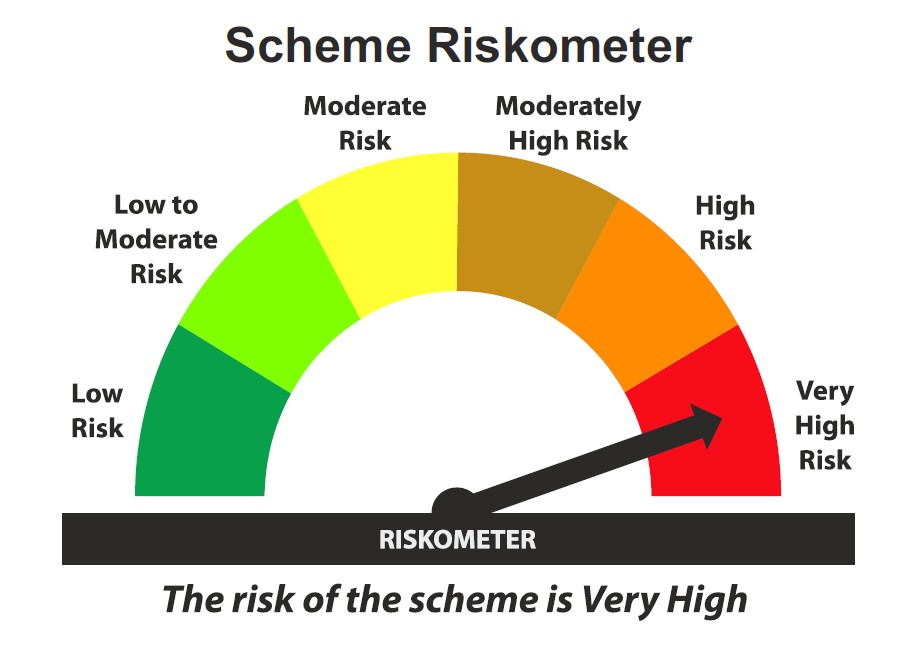

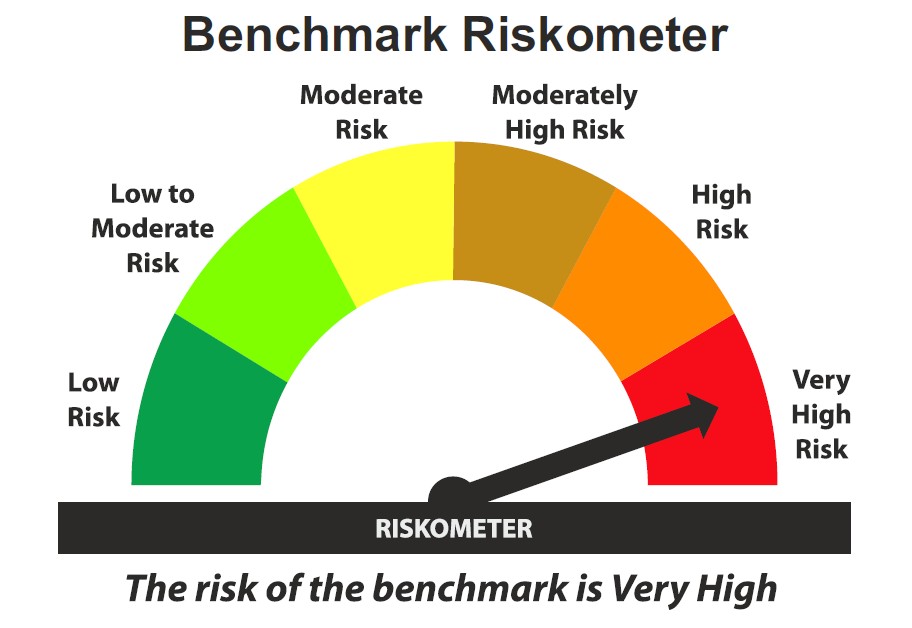

RiskometerThis product is suitable for investors who are seeking*

| |

|

|

It may be noted that risk-o-meter specified above is based on internal assessment. The same shall be updated as per provision no. 17.4.1.i of SEBI Master Circular on Mutual Fund dated 27.06.2024, on Product labelling in mutual fund schemes on ongoing basis.

Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

3 simple steps to become a KYC compliant investor.

Wish to know more about Mutual Funds?

We are happy to clarify all your doubts. Share your contact details, and our team will reach out to you.