The Simplicity of Tata Multi Asset Opportunities Fund

At Tata Mutual Fund, we understand that navigating the investment landscape can be daunting. With a plethora of options, from equities and bonds to alternative assets, deciding on the right mix can be a complex and time-consuming process. This is where multi asset allocation funds emerge as a powerful tool for investors seeking a potentially diversified, approach.

Multi Asset Funds Explained:

Multi asset opportunities funds, a category of hybrid funds, are a type of mutual fund that combines investments across various asset classes within a single portfolio. Equity (stocks), debt (bonds), and sometimes even alternative assets like real estate or gold can be included, with the specific allocation determined by the fund manager based on the fund's investment objective and risk profile. This can range from conservative options with a higher focus on debt to more aggressive choices with a larger equity allocation.

Why Choose Tata Multi Asset Opportunities Fund?

- Potential for Diversification: Diversification and low correlation across equity, commodities, fixed income as well as commodity arbitrage helps reduce risk with potentially less volatile returns and aims to deliver consistency of returns..

- Convenience and Expertise: By investing in a multi asset fund, you eliminate the need to research and select individual investments from each asset class. Automatic rebalancing is done by a team of specialists, who are professional asset managers.

Our experienced fund managers take the reins, actively managing the asset allocation within the fund based on market conditions and the fund's goals.

- Potential for Risk-Adjusted Returns: Our multi asset funds are meticulously designed to balance the pursuit of potential returns with managing risk. Through strategic asset allocation, we aim for competitive returns while trying to achieve lower overall volatility compared to a portfolio solely focused on equities.

- Returns across market phases: Tata Multi Asset Opportunities Fund would have minimum exposure towards 65% equities, maximum 25% towards commodities (predominantly commodity arbitrage and will include Gold) and minimum 10% Fixed Income. Commodities, through arbitrage and selective directional strategies, have the potential to diversify the portfolio.

Who Can Benefit from Tata Multi Asset Opportunities Fund?

This fund caters to a broad spectrum of investors, including:

- New Investors: Just starting your investment journey? Our multi-asset funds offer a convenient and diversified way to gain exposure to different markets without the complexities of individual stock picking.

- Risk-Averse Investors: Do you prioritize capital preservation over high-risk, high-reward scenarios? The diversification offered by these funds may provide a sense of security, helping you achieve your financial goals while minimizing downside risk.

- Long-Term Investors: Multi-asset funds can be a cornerstone of your long-term investment strategy. With a diversified approach, your portfolio can aim to grow steadily over time, allowing you to reach your long-term financial aspirations.

Embrace a Simpler, Smarter Investment Journey

Multi asset funds offer a solution for investors seeking a simpler, more diversified approach to wealth creation.

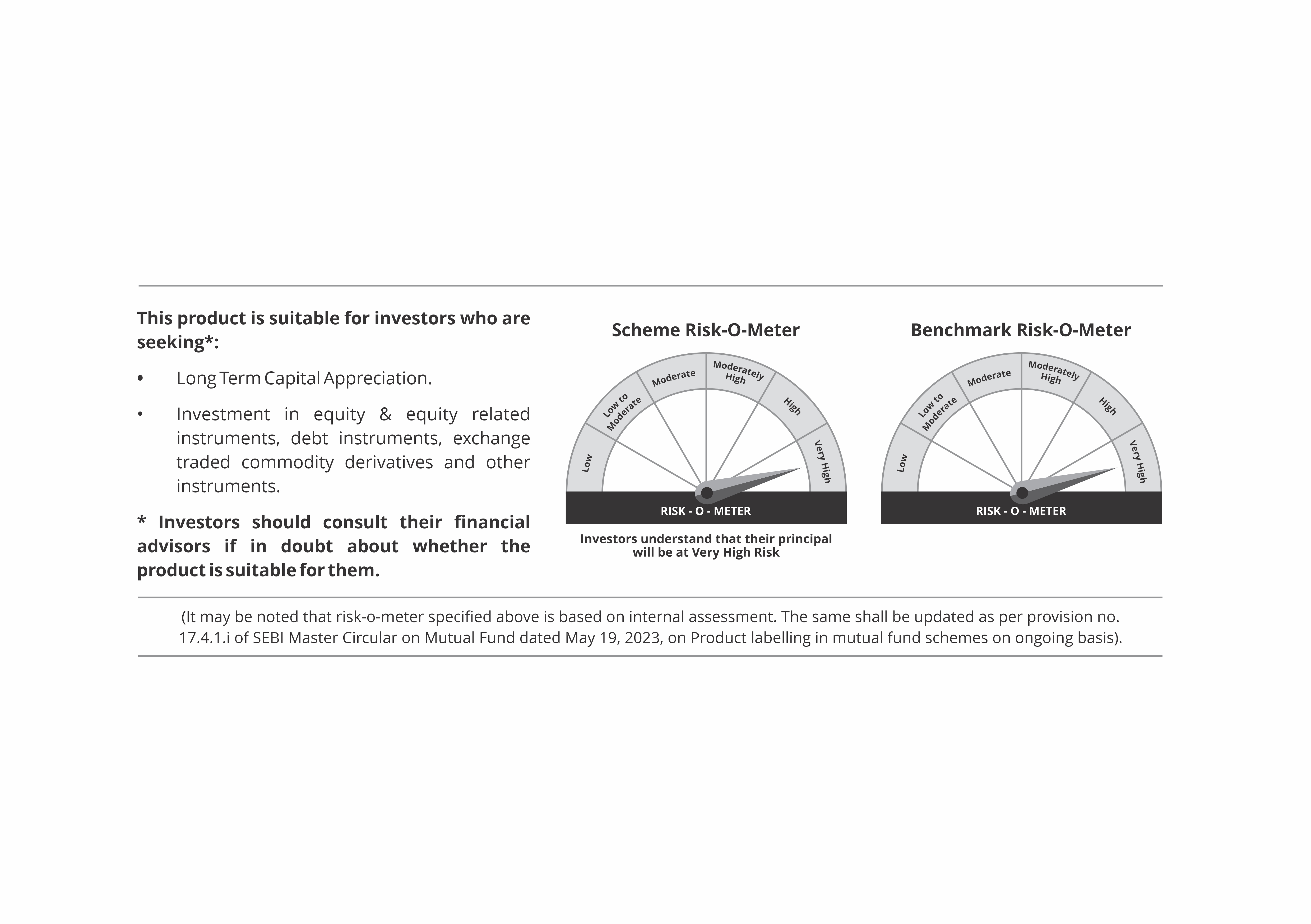

Multi asset mutual funds can be an addition to your investment portfolio if you are willing to take very high risks for probable high returns. You must do your homework before investing or consult your Mutual Fund Distributor if this category is suitable to help you to achieve your goals.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Know more about the fund - https://shorturl.at/UKMlQ