Investing in mutual funds has always been a strategic way to diversify your portfolio and achieve long-term financial goals. With the launch of the Tata Income Plus Arbitrage Active Fund of Fund (FoF), investors have a new opportunity to potentially enhance their returns through a balanced mix of equity arbitrage and debt-oriented mutual fund schemes. This blog post will delve into the details of this New Fund Offer (NFO), highlighting its unique features, investment strategy, and potential benefits for investors.

What is Tata Income Plus Arbitrage Active Fund of Fund?

The Tata Income Plus Arbitrage Active Fund of Fund is an open-ended fund of fund that invests in domestic mutual funds, including debt-oriented mutual fund schemes and arbitrage-based equity mutual fund schemes. The primary objective of this fund is to provide long-term capital appreciation by leveraging a blended strategy of low volatility, accrual, and equity arbitrage returns.

Key Features of Tata Income Plus Arbitrage Active Fund of Fund

- Investment Mix: The fund invests a maximum of 70% of its corpus in debt schemes, including cash and cash equivalents, and a minimum of 35% in equity arbitrage mutual fund schemes. This 70/35 mix aims to achieve growth potential and capitalize on dynamic market conditions.

- Tax Efficiency: One of the significant advantages of this fund is its better tax efficiency compared to regular debt funds. The 65/35 debt-arbitrage mix combines dynamic debt allocation and equity arbitrage, offering long-term capital gains tax benefits of 12.5% if held for more than 24 months. This is compared to the slab rates for regular debt funds.

- Dynamic Debt Allocation: The debt allocation is managed dynamically to adapt to changing markets, while the arbitrage exposure allows investors to potentially benefit from market fluctuations without taking directional equity risk.

- Diversified Exposure: This fund of fund approach provides the convenience of diversified exposure, managed by an expert team, all through a single investment.

Investment Strategy

The Tata Income Plus Arbitrage Active Fund of Fund employs a strategic allocation to both debt and equity arbitrage funds to achieve its investment objectives. Here’s a closer look at the investment strategy:

- Debt Allocation: The fund invests in debt-oriented mutual fund schemes, predominantly in the Tata Corporate Bond Fund. This allocation aims for largely accrual returns with some active duration management. The Tata Corporate Bond Fund focuses on high credit quality (80%+ in AA+/sovereign), active duration strategy (1-4 years), and smart bond selection to enhance returns.

- Equity Arbitrage Allocation: The fund also invests in the Tata Arbitrage Fund, which maintains a 100% hedged equity portfolio via arbitrage, aiming for short-term returns. The Tata Arbitrage Fund focuses on rollover spreads, intramonth trades, dynamic churn, market cap shifts, and active exposure and stock selection.

Why Invest in Tata Income Plus Arbitrage Active Fund of Fund?

Investing in the Tata Income Plus Arbitrage Active Fund of Fund could be a suitable choice for various types of investors. Here are some reasons why you might consider this fund:

- Potential for Capital Appreciation: The fund aims to provide long-term capital appreciation by leveraging a balanced mix of equity arbitrage and debt-oriented mutual fund schemes.

- Tax Benefits: The fund offers better tax efficiency compared to regular debt funds, with long-term capital gains tax benefits of 12.5% after 24 months.

- Diversified Portfolio: The fund provides diversified exposure to both debt and equity arbitrage funds, managed by an expert team.

- Dynamic Management: The debt allocation is managed dynamically to adapt to changing market conditions, potentially enhancing returns.

- Low Volatility: The fund’s blended strategy aims for low volatility, making it a suitable choice for conservative investors seeking stable returns.

Who Should Invest?

The Tata Income Plus Arbitrage Active Fund of Fund could be a suitable investment option for:

- Conservative Investors: Those looking to capitalize on debt investments with the potential for stable returns.

- Investors Seeking Tax Efficiency: Those who want to benefit from better tax efficiency compared to regular debt funds.

- Investors Seeking Diversification: Those looking for diversified exposure to both debt and equity arbitrage funds.

- Investors with a Long-Term Horizon: Those who can hold their investments for more than 24 months to benefit from long-term capital gains tax benefits.

Scheme Details for Tata Income Plus Arbitrage Active Fund of Fund

Here are some essential details about the Tata Income Plus Arbitrage Active Fund of Fund:

- Minimum Subscription Amount: ₹5,000 and in multiples of ₹1 thereafter.

- Exit Load: 0.25% of the applicable NAV if redeemed/switched out/withdrawn within 30 days from the date of allotment.

- Fund Managers: Mr. Sailesh Jain and Mr. Abhishek Sonthalia (Co-Fund Manager).

- NFO Period: Opens on 05th May 2025 and closes on 19th May 2025.

The Tata Income Plus Arbitrage Active Fund of Fund offers a unique investment opportunity for those looking to diversify their portfolio with a balanced mix of equity arbitrage and debt-oriented mutual fund schemes. With its potential for capital appreciation, better tax efficiency, and dynamic management, this fund could be a suitable choice for conservative investors, those seeking tax benefits, and those with a 2+ years investment horizon. As always, it is essential to consult with your financial advisor to determine if this fund aligns with your investment goals and risk tolerance.

Explore our new fund offering, Tata Income Plus Arbitrage Active Fund of Funds, and take a step towards achieving your financial goals.

Scheme Details Tata Corporate Bond Fund:

- Scheme Name: Tata Corporate Bond Fund

- Scheme Category: Corporate Bond Fund

- Scheme Type: An open-ended debt scheme predominantly investing in AA+ & above rated corporate bonds, with flexibility of any Macaulay Duration & relatively high interest rate risk & moderate credit risk.

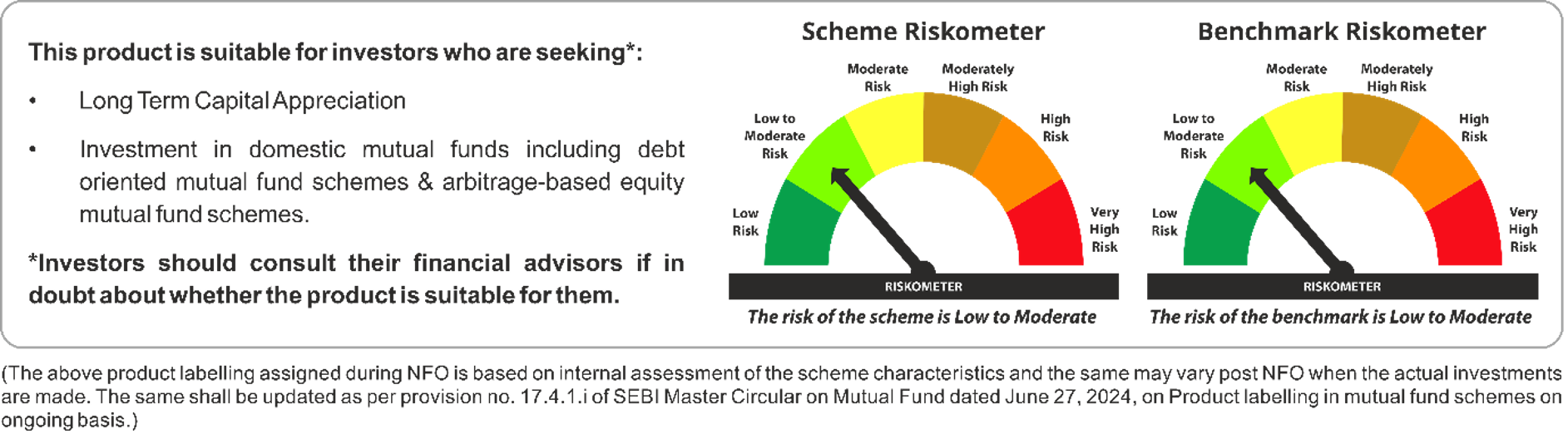

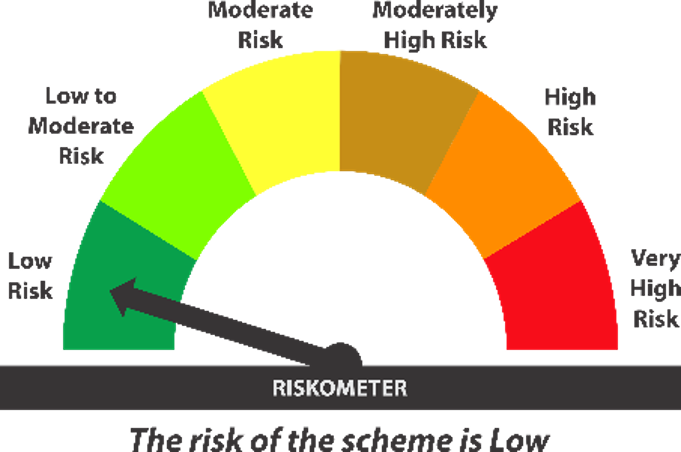

This product is suitable for investors who are seeking*:

| Scheme Risk-O-Meter | Benchmark Risk-O-Meter | |

|  |  |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them | ||

| It may be noted that risk-o-meter specified above is based on internal assessment. The same shall be updated as per provision no. 17.4.1.i of SEBI Master Circular on Mutual Fund dated 27.06.2024, on Product labelling in mutual fund schemes on ongoing basis. | ||

Potential Risk Class Matrix

B-III is the potential risk class matrix of Tata Corporate Bond Fund based on interest rate & credit risk.

Potential Risk Class | |||

| Credit Risk | Relatively Low | Moderate | Relatively Low |

| Interest Risk Rate | |||

| Relatively Low (Class I) |

|

|

|

| Moderate (Class II) |

|

|

|

| Relatively High (Class III) |

| B-III |

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

Scheme Details Tata Arbitrage Fund:

- Scheme Name: Tata Arbitrage Fund

- Scheme Category: Arbitrage Fund

- Scheme Type: An open-ended scheme investing in arbitrage opportunities.

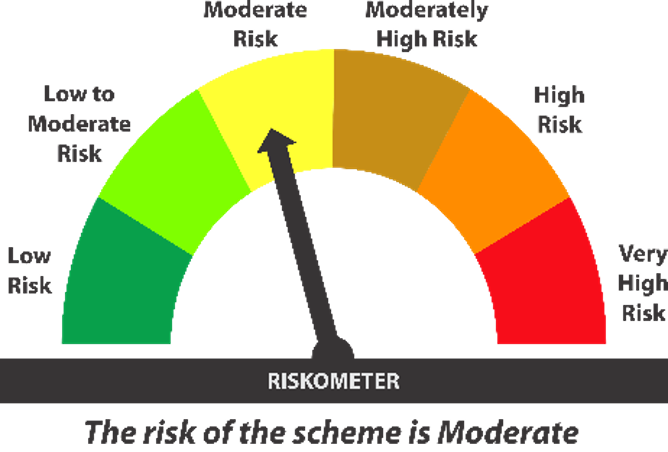

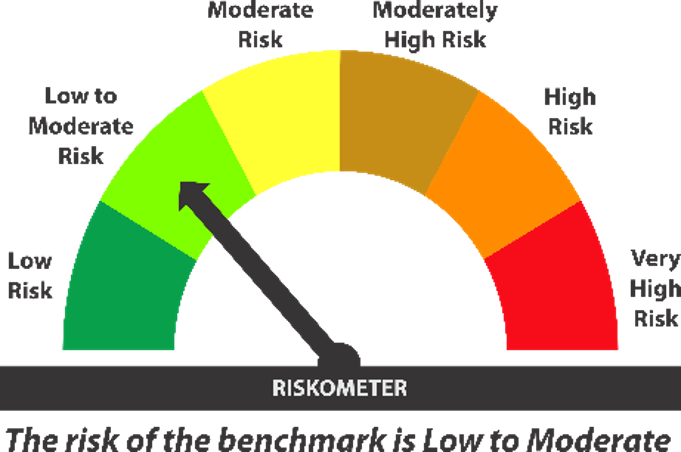

This product is suitable for investors who are seeking*:

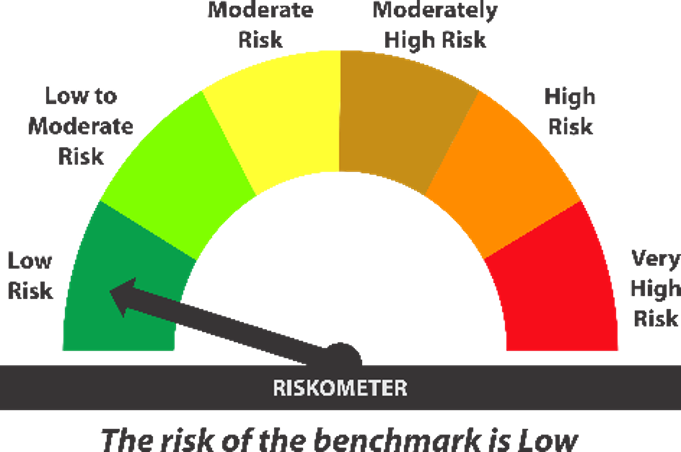

| Scheme Risk-O-Meter | Benchmark Risk-O-Meter | |

|  |  |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them | ||

| It may be noted that risk-o-meter specified above is based on internal assessment. The same shall be updated as per provision no. 17.4.1.i of SEBI Master Circular on Mutual Fund dated 27.06.2024, on Product labelling in mutual fund schemes on ongoing basis. | ||

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully.