For investors seeking an ideal balance between growth and stability, a mid cap fund offers an appealing middle ground. It captures the potential of fast-growing mid-sized companies, while potentially maintaining a level of maturity and resilience not often found in smaller-cap firms.

The Tata Mid Cap Fund is designed to help investors tap into this opportunity. This article explores how midcap investing works, how this fund fits into your long-term financial goals, and why it may be a smart choice for those looking to build wealth steadily.

What is a Mid Cap Fund?

A mid cap fund is an equity mutual fund that invests predominantly in mid-sized companies, typically ranked between 101 and 250 on the stock exchange in terms of market capitalisation. These companies are often past the early start-up stage and are now growing rapidly, expanding their operations, revenues, and market presence.

What makes them attractive is that they offer:

- Greater growth potential than large caps

- More potential for resilience than small caps

- Opportunities that are sometimes under-researched or undervalued

When you invest in a mid cap mutual fund, you are essentially investing in companies that are climbing the ladder to become tomorrow’s market leaders.

Introducing Tata Mid Cap Fund

The Tata Mid Cap Fund focuses on capturing the long-term growth opportunities presented by India’s evolving midcap space. With an investment philosophy grounded in fundamental analysis and sector diversification, this fund seeks to deliver capital appreciation while managing volatility.

It invests in companies that have:

- Scalable business models

- Strong earnings potential

- Competitive advantages in niche or growing markets

By concentrating on mid-sized companies that are expected to benefit from structural and cyclical growth, the fund aims to generate returns over the long term.

Why Invest in a Mid Cap Fund?

Here are a few reasons investors opt for midcap exposure through mutual funds:

High Growth Potential

Mid-sized companies are in their expansion phase and may grow faster than larger, more established firms. A well-managed mid cap fund can capture this growth efficiently.

Diversification

Midcap companies operate across sectors and geographies. This offers exposure to a wide variety of industries, enhancing portfolio diversification.

Potential for Long-Term Wealth Creation

While they may be volatile in the short term, mid cap mutual funds have historically delivered strong returns for investors who stay invested for 5 years or more. (According to Value Research and historical AMFI data, several mid cap funds have shown CAGR returns upwards of 15–17% over 5–10 year periods, outperforming their large-cap counterparts during the same horizon. This long-term performance is often driven by sustained earnings growth, sector tailwinds, and valuation rerating of quality midcap businesses.)

Active Fund Management

Funds like Tata Mid Cap Fund are typically actively managed, meaning fund managers research, analyse, and select stocks they believe will outperform.

Where Do Mid Cap Funds Invest?

The fund universe for mid caps typically comes from indices like the:

- Nifty Midcap 150 TRI

- Nifty 50 TRI

These indices represent the core pool of mid-sized companies from which fund managers curate portfolios. The mid cap index provides a benchmark against which performance is often measured.

Performance Potential of Mid Cap Mutual Funds

While past performance is not indicative of future results, mid cap mutual funds’ returns have, over long investment horizons, outpaced their large-cap counterparts. This is due to:

- Strong earnings growth in emerging sectors

- Re-rating of undervalued companies

- Market discovery of quality midcaps over time

That said, these funds can experience short-term volatility, making them better suited for investors with a medium to long-term perspective.

SIP or Lumpsum: What Works Better?

Investors can choose to invest in the Tata Mid Cap Fund either through:

- Systematic Investment Plans (SIPs): Investing small amounts on regular basis helps average out the cost and reduces the impact of market timing.

- Lumpsum Investment: Suitable when the market is attractively valued or for investors with a long horizon and surplus capital.

Using tools like a SIP calculator or investment return calculator helps estimate future returns based on your inputs, making goal planning more tangible.

Investor Profile: Who Should Consider Midcap Investing?

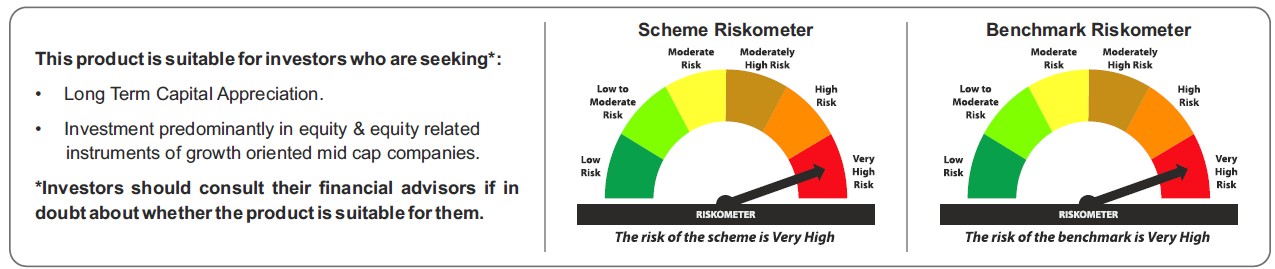

The Tata Mid Cap Fund is best suited for:

- Investors with a long-term horizon (5–7 years)

- Individuals comfortable with high risk

- Those seeking to diversify their equity portfolio

- Investors who want to capitalise on the growth potential of mid-cap companies

It is not ideal for very conservative investors or those needing short-term liquidity.

Things to Know Before Investing

Volatility

Midcap stocks can experience sharp price movements due to market sentiment or sectoral factors. Be prepared for ups and downs.

Long-Term Patience Pays

While short-term volatility is part of the journey, staying invested for the long term can unlock the real growth potential.

Portfolio Diversification

This fund includes companies across sectors like manufacturing, infrastructure, consumer goods, technology, and financial services—ensuring a well-balanced approach.

How Tata Mid Cap Fund Manages Risk

The fund follows a diversified, bottom-up stock-picking strategy. Risk is managed by:

- Avoiding over-concentration in any one sector

- Focusing on companies with strong balance sheets

- Monitoring macroeconomic indicators and regulatory developments

- Using internal research and rigorous due diligence

Mid Cap Fund vs. Large Cap Fund

| Feature | Mid Cap Fund | Large Cap Fund |

|---|---|---|

| Market Cap Focus | Companies ranked 101–250 | Top 100 companies |

| Volatility | Medium to High | Low to Medium |

| Ideal Holding Period | 5 years or more | 3–5 years |

| Risk Appetite | High | High |

While both have their place in a portfolio, mid cap funds offer that extra edge for wealth creation - if aligned with your risk appetite and time horizon.

How to Track Fund Performance

To stay informed, consider tracking:

- Rolling returns over 1, 3, and 5 years

- Portfolio turnover and sector allocation

- Comparison with the midcap 100 index

- Expense ratio and exit load terms

- Risk indicators like standard deviation and beta

How to Start Your Investment

Starting your investment journey with the Tata Mid Cap Fund is easy:

- Visit the official Tata Mutual Fund website or a registered distributor.

- Complete your KYC process (PAN, Aadhaar, address proof).

- Choose between SIP or Lumpsum.

- Use the SIP return calculator to align investment amount with your goals.

- Monitor regularly but don’t panic during short-term volatility.

Final Thoughts

The Tata Mid Cap Fund brings together the potential of fast-growing companies with the disciplined approach of expert fund management. It is well-suited for investors who are looking beyond the predictable paths of large caps and are willing to stay invested to unlock meaningful returns.

Whether you’re starting your investment journey or rebalancing your portfolio for the future, adding a mid cap mutual fund like this one could help accelerate your long-term financial goals.

|  |

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.