When exploring mutual fund schemes, especially equity-oriented ones - you might come across a term called the P/E ratio. Understanding what it means and how it impacts your investment decision can help you make smarter choices, particularly when evaluating value-oriented schemes like Tata Value Fund.

This article will explain what is P/E ratio in mutual funds, how it is used by fund managers and investors, and how the Tata Value Fund applies this principle in practice.

What is P/E Ratio in Mutual Fund Context?

The Price-to-Earnings (P/E) ratio is a widely used financial metric that helps investors assess whether a stock or a collection of stocks is relatively overvalued or undervalued. It is calculated by dividing the current market price of a company’s share by its earnings per share (EPS).

P/E Ratio = Market Price per Share ÷ Earnings per Share (EPS)

Within the realm of mutual funds, the P/E ratio represents the weighted average of the P/E ratios of the constituent companies in the portfolio. This metric provides investors with a general indication of whether the fund is allocated towards stocks that are relatively overvalued or undervalued.

For example, a lower P/E ratio suggests that the stocks in the fund are available at lower valuations compared to their earnings potential, which is generally considered a value investing approach. Conversely, a high P/E may indicate growth-oriented investing.

Why Does P/E Ratio Matter to Mutual Fund Investors?

Understanding the P/E ratio in mutual funds can give you a sense of the fund’s investment style:

- Low P/E ratio: Indicates a value strategy where the fund manager is investing in companies that are currently undervalued but have strong long-term potential.

- High P/E ratio: Reflects growth-oriented investing where the focus is on companies with high earnings potential, even if their current valuations are expensive.

Benefits of Using P/E as a Metric in Mutual Funds:

- Valuation Insight: Helps in assessing whether the fund portfolio is expensive or reasonably priced.

- Risk Assessment: Lower P/E generally implies lower downside risk in volatile markets.

- Style Differentiation: Clarifies whether a fund follows value, growth, or blended investment strategies.

Introducing Tata Value Fund

The Tata Value Fund is a value-oriented equity mutual fund that applies the P/E filter as a core investment principle. It predominantly invests in stocks whose rolling P/E ratio is lower than that of the BSE Sensex - making it a strong candidate for investors seeking a value-based approach to wealth creation.

Fund Snapshot:

- Fund Type: Open-ended equity scheme following a value investment strategy

- Launch Date: June 29, 2004

- Benchmark: Nifty 500 TRI

- Number of Holdings: 37

Investment Philosophy of Tata Value Fund

This fund’s investment strategy is built on the belief that markets tend to misprice stocks in the short term. By identifying fundamentally strong companies that are temporarily undervalued due to macro or sectoral challenges, the fund aims to deliver long-term capital appreciation.

Key Principles:

- Invests at least 70% of assets in stocks with P/E below BSE Sensex’s P/E.

- Uses a rolling P/E filter to screen the stock universe.

- Employs bottom-up stock selection with a focus on consistent Return on Equity (RoE) and capital efficiency.

- Maintains diversification across large, mid, and small-cap stocks based on value potential.

Sector Allocation:

- High exposure to domestic-facing sectors: Financial Services, Energy, Textiles, Media, Utilities

- Selective overweight on power-related lenders, brokerages, and market leaders with strong brand equity

- Underweight exposure to the IT sector and industries currently seen as overvalued

Why Tata Value Fund?

This fund offers a unique advantage for investors seeking value with growth potential. Here’s why:

1. Focused Value Strategy

The fund promotes disciplined value investing by evaluating stocks according to their rolling P/E ratio relative to the BSE Sensex.

2. Fund Managers

Tata Value Fund, backed by over 20 years of market experience and guided by expert fund managers.

- Sonam Udasi (since April 2016; 27 years of experience)

- Amey Sathe (Fund Manager since 1st July 2023) (Assistant Fund Manager since 18th June 2018 till 30th June 2023; 17 years of experience)

3. Diversified Exposure

Although the value strategy is employed, the portfolio maintains a diversified approach. It encompasses various sectors and market capitalisations, which aids in mitigating risk.

4. Smart Rebalancing

The fund periodically adjusts its allocations to realise gains in sectors that are overvalued while increasing its investments in fundamentally strong stocks that are currently undervalued.

Who Should Invest?

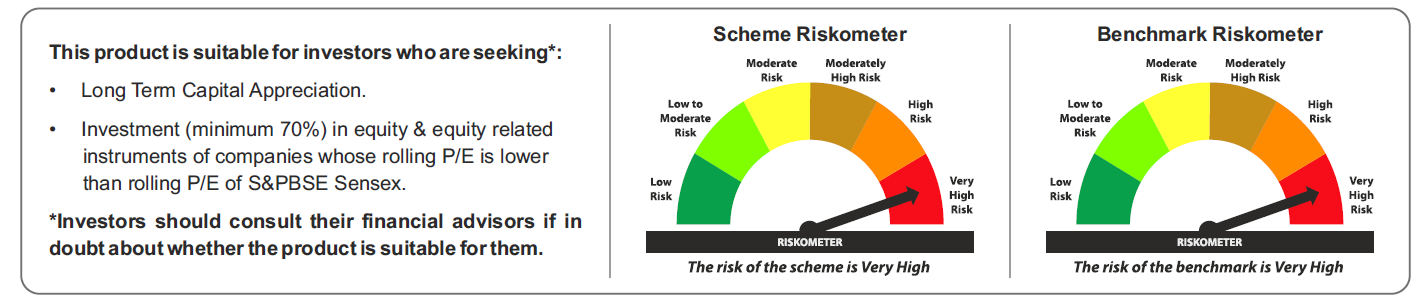

Tata Value Fund may be ideal for:

- Long-term investors seeking capital appreciation through value investing

- Investors looking for alternatives to growth-biased funds

- Individuals who understand that value may take time to unlock

- Those comfortable with moderate market volatility in pursuit of long-term outperformance

P/E Ratio and Risk

While the fund’s use of P/E provides a valuation cushion, investors must remember that:

- A low P/E doesn’t always guarantee an upside - some stocks may be cheap for valid reasons.

- P/E-based investing requires patience; value stocks may take time to gain investor confidence.

- Macro factors, sectoral headwinds, and sentiment shifts can still affect short-term returns.

That said, combining P/E as a filter with strong fundamentals enhances the probability of success over the long term.

Things to Keep in Mind

- Minimum Investment: ₹5,000 (lumpsum), SIP options also available

- Exit Load: 1% if redeemed within 365 days

- 1. On or before expiry of 12 months from the date of allotment: If the withdrawal amount or switched out amount is not more than 12% of the original cost of investment-NIL

- 2. On or before expiry of 12 months from the date of allotment: If the withdrawal amount or switched out amount is more than 12% of the original cost of investment-1%

- 3. Redemption after expiry of 12 months from the date of allotment-NIL

- Expense Ratio: ~1.02% (Direct plan), may vary by plan

- Fund Risk-o-meter: Very High

- Benchmark Risk: Very High

It is essential to consider your financial objectives, investment timeline, and risk appetite prior to making any investments. While a value fund may lag behind in thriving growth-oriented markets, it can provide enhanced stability during periods of market downturns.

Final Thoughts

The Price-to-Earnings (P/E) ratio of mutual funds serves as a significant indicator when interpreted within the appropriate context. It offers insight into the valuation strategy of a fund and aids in establishing achievable expectations.

The Tata Value Fund exemplifies a disciplined value investing methodology, demonstrating how this ratio can inform stock selection and long-term investment strategies. For investors who prioritise acquiring fundamentally robust companies at appealing valuations and are prepared to allow their investments to mature, this fund represents a worthwhile enhancement to their investment portfolio.

|  |

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.