In a country as diverse as India, the demand for investment solutions that align with personal values and ethical beliefs is steadily growing. For many investors who seek to align their finances with faith-based principles, Shariah compliant mutual funds offer a transparent and responsible way to participate in capital markets. Among the most established offerings in this category is the Tata Ethical Fund.

This article aims to explore the philosophy behind Shariah investment, explain how the Tata Ethical Mutual Fund is structured, and help investors understand how such funds can support their long-term financial goals without compromising their ethical framework.

What is a Shariah Compliant Mutual Fund?

A Shariah compliant mutual fund is a type of investment fund that adheres to Islamic principles as outlined in the Shariah, or Islamic law. These funds avoid investing in businesses that deal with interest-based financial services, alcohol, tobacco, gambling, and other activities considered non-compliant under Shariah.

Key Features of Shariah Mutual Funds:

- Avoid interest (riba) and debt-laden companies

- Exclude sectors like liquor, entertainment, banking, and insurance

- Select companies based on ethical business practices

- Guided by a Shariah Board of scholars who review and certify the fund’s portfolio

In India, such funds are available to all investors - regardless of religion - who wish to follow an ethical or socially responsible approach to investing.

Introduction to Tata Ethical Fund

The Tata Ethical Fund is a pioneering equity mutual fund in India built on the principles of Shariah investment. Launched in 1996, it remains one of the oldest and most respected offerings in this category.

Highlights:

- Invests in companies that are certified as Shariah compliant

- Actively managed, with a focus on long-term capital appreciation

- Follows a disciplined stock-picking approach guided by an internal research team and Shariah Board

The fund aims to deliver returns by focusing on businesses that demonstrate strong fundamentals, financial prudence, and compliance with ethical investment norms.

What Makes Shariah Investing Unique?

Unlike traditional equity funds, a Shariah fund evaluates stocks not just on financial metrics but also on ethical compliance. This includes:

- Low debt-to-equity ratio

- Clean sources of income

- Absence from sectors prohibited under Shariah law

As a result, these funds typically show a bias towards sectors like:

- Pharmaceuticals

- Information Technology

- Engineering

- Fast-Moving Consumer Goods (FMCG)

This approach not only helps to align with moral values but also ensures that the investment is grounded in sound financial principles.

Who Can Invest in Tata Ethical Mutual Fund?

While the fund is Shariah-compliant by design, it is open to all investors - regardless of faith - who are looking for:

- An ethical investment vehicle

- Diversified equity exposure

- Long-term capital appreciation

- Portfolio alignment with socially responsible investing principles

Investors are comfortable with avoiding sectors like banking, alcohol, and entertainment, and focusing on fundamentally strong businesses may find this fund suitable.

Why Consider Shariah Compliant Mutual Funds?

Here are a few reasons why investors are increasingly considering mutual fund Shariah compliant options:

Ethical Alignment

Invest according to your values without compromising on potential growth opportunities.

Financial Discipline

The fund inherently screens for companies with low debt and clean financial records.

Long-Term Growth

With the right asset allocation and discipline, Shariah funds have shown the potential to deliver wealth over the long term.

Transparent Process

These funds are guided by a Shariah Board, ensuring continuous monitoring and compliance.

How Does Tata Ethical Fund Work?

The fund manager of Tata Ethical Fund follows a multi-step investment process:

- Screening: Initial filtration based on Shariah compliance - excluding all prohibited industries

- Financial Metrics: Evaluation of earnings quality, balance sheet strength, and growth potential

- Fundamental Analysis: Focus on companies with robust corporate governance and capital efficiency

- Ongoing Compliance: Periodic reviews by the Shariah advisory board to ensure continued adherence

The fund is actively managed, meaning that stocks are regularly bought or sold based on market conditions and compliance updates.

Key Benefits of Tata Ethical Fund

Here’s what makes the Tata Ethical Mutual Fund stand out:

- SEBI-registered open-ended equity scheme

- Run by experienced fund managers

- Supported by one of India’s most trusted financial groups

- Enables investors to participate in equity markets with ethical clarity

If you prefer to avoid companies that go against your values, this fund allows you to do so without stepping away from financial markets.

Tata Ethical Fund NAV and Plan Options

Investors can track the Tata Ethical Fund NAV (Net Asset Value) on the Tata Mutual Fund website or any registered financial platform. NAV helps assess the current per-unit value of the mutual fund and is updated daily.

Available Plans:

- Tata Ethical Fund Direct Plan Growth

- Regular Plan – suitable for investors going through a distributor

Choosing between the two depends on your investment preference and whether you seek advisory assistance or prefer a direct route with lower expense ratios.

Investing in Tata Ethical Fund: SIP or Lumpsum?

Like most mutual funds, the Tata Ethical Fund allows investments through:

- Systematic Investment Plans (SIP): Suitable for building wealth gradually with monthly contributions

- Lumpsum Investments: Suitable for investors with available capital and long-term goals

Using a SIP calculator or investment return calculator can help estimate future wealth accumulation and create a customized plan for financial goals like education, retirement, or home purchase.

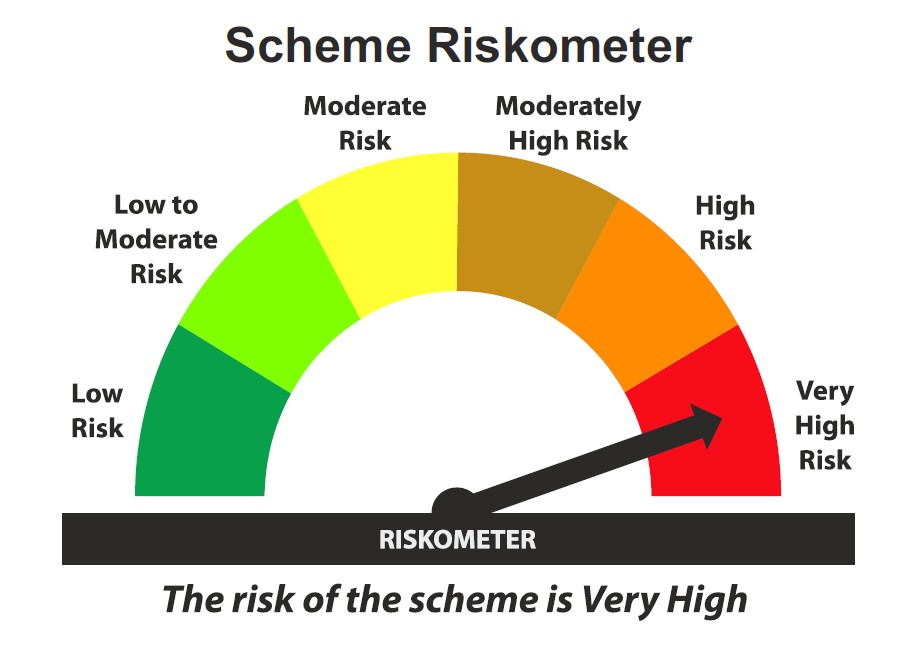

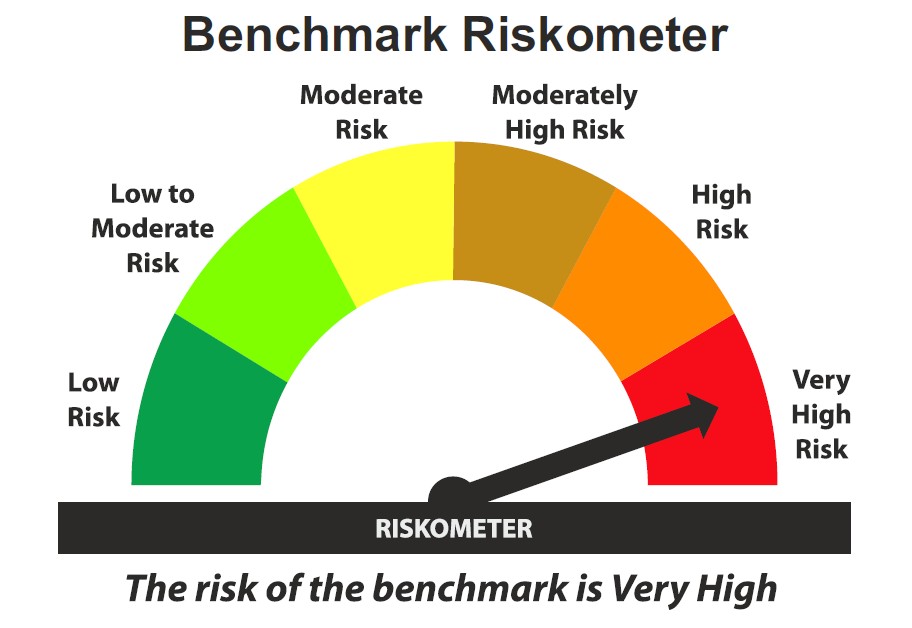

Risk Factors to Keep in Mind

While Shariah mutual funds are designed with discipline, they are not risk-free. Here are some points to consider:

- Sector Concentration: Avoiding certain sectors may lead to concentration in others

- Market Risk: Like all equity funds, returns depend on market movements and are not guaranteed

- Liquidity Risk: May face limited stock choices, especially in narrow markets

Investors are advised to stay invested for a period of 5 years or more to ride out market cycles and potentially maximize returns.

Who Should Consider Investing?

The Tata Ethical Fund may be suitable for:

- Faith-driven investors seeking Shariah investment opportunities

- Long-term investors with a very high risk appetite

- Individuals who want to align personal ethics with portfolio choices

How to Get Started

To begin your journey with Tata Ethical Mutual Fund, follow these steps:

- Complete KYC formalities

- Choose between Direct or Regular Plan

- Decide SIP or lumpsum

- Select goal and investment horizon

- Track progress using NAV and periodic statements

Investors can also seek guidance from registered mutual fund distributors or visit www.tatamutualfund.com for more information.

Final Thoughts

Ethical investing is no longer a niche concept. With funds like the Tata Ethical Fund, investors can now make decisions that are both financially sound and morally aligned. Whether you are driven by religious values, ethical convictions, or the desire for responsible investing, Shariah compliant mutual funds offer a structured way to grow your wealth.

In a market filled with choices, the Tata Ethical Fund brings clarity, transparency, and a focused approach to potential long-term capital appreciation - without compromising on your values.

| This product is suitable for investors who are seeking*

|

|

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.